I reproduce a post on LinkedIn with some additions that I think is relevant to our readers.

Silver action suggests markets are not pricing in a recession. SLV bottomed on 4/4/2025. Since then, it has almost touched its last recorded highs. >>> implication: Silver is used in industry. The market collapsed when it discounted the worst; now, it anticipates not-so-bad times ahead.

GLD dances to its own tune. No comments. It the USD self-destructs, then gold will go >$10K. But we are not there yet or never in the foreseeable future.

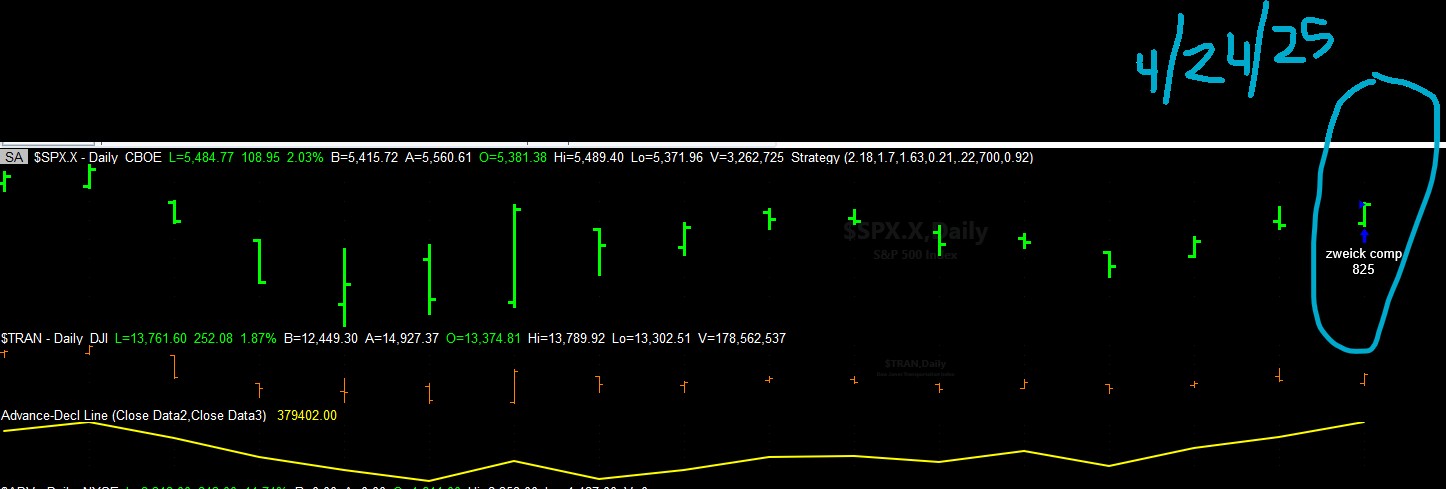

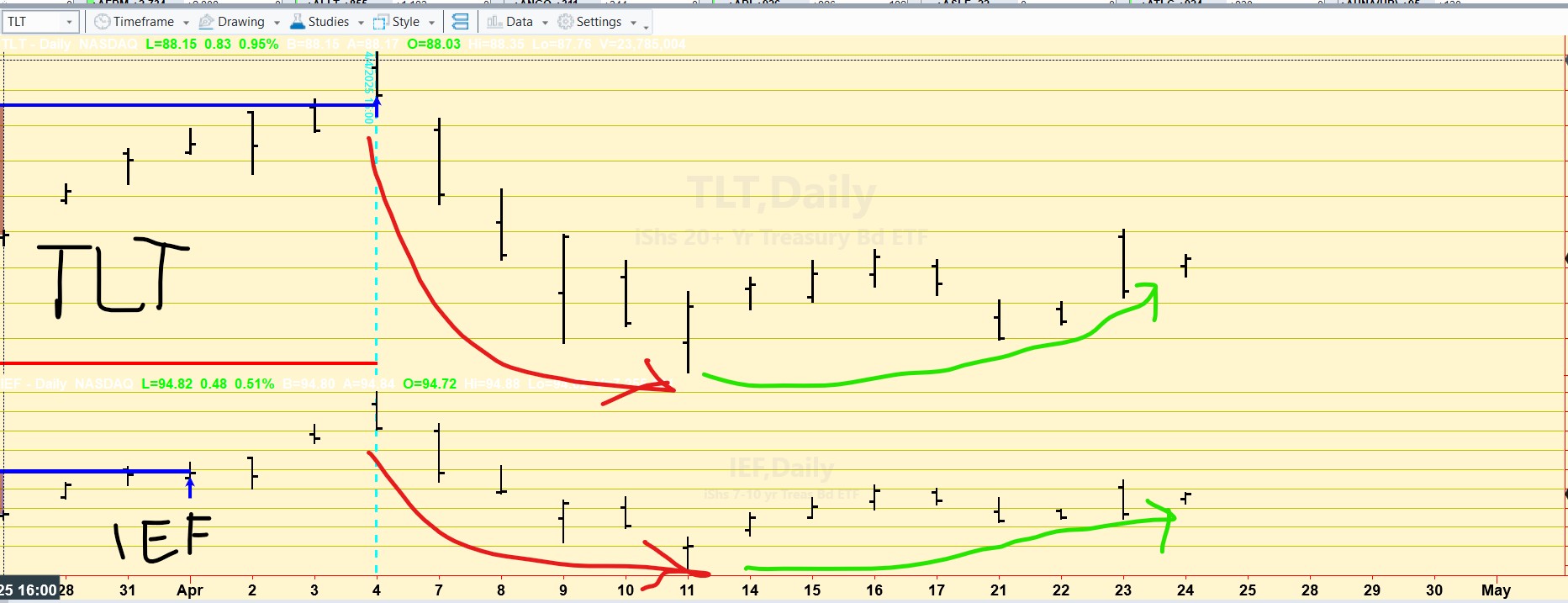

U.S. bonds? Quietly in a bull market (yes, really), as I explained in this post. While scary, the recent pullback didn’t qualify as a correction. On 4/11/25, TLT and IEF bottomed (higher interest), now it seems TLT and IEF want to go up (lower interest rates). As of April 11, the bullish trend has resumed.

Bitcoin hit higher highs yesterday, fueled by robust liquidity support.

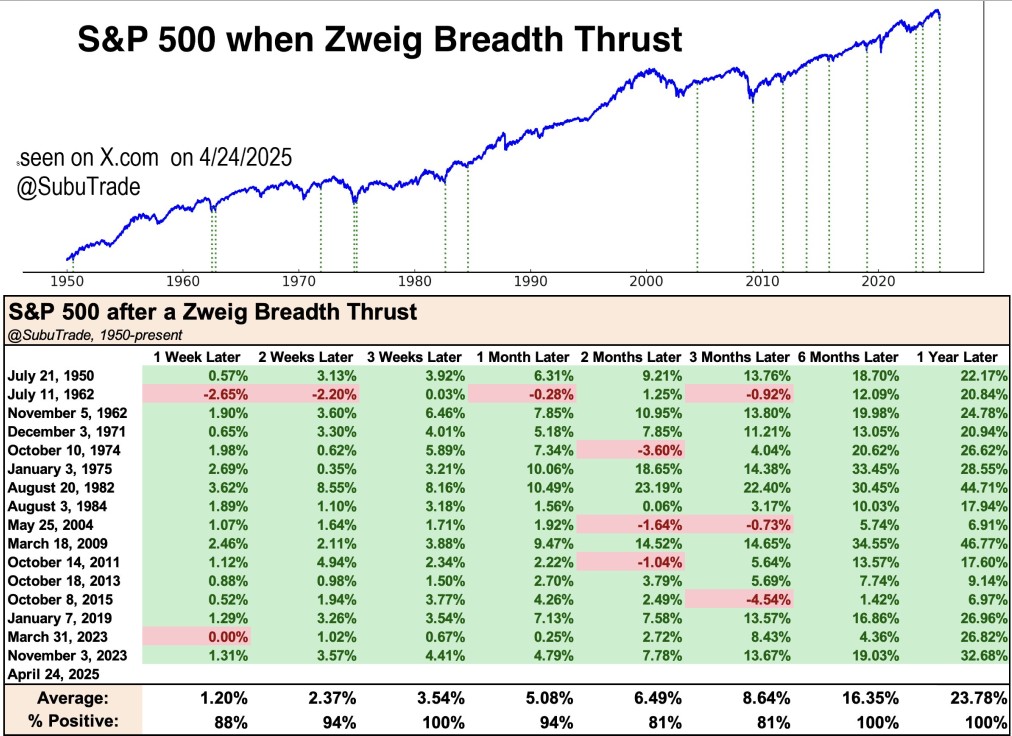

And let’s not forget: our Capitulation Indicator signaled on April 7–8 that the bottom was likely in, as I explained in my 4/7/25 email to Subscribers, available to them in the Subscriber’s Portal.

As a reminder, Capitulation has an incredible record at pinpointing bottoms. So, it should be taken seriously.

Connect the dots, and the message is clear: the worst may be behind us.

Please excuse the rough charts. Time has been scarce, but they should still effectively illustrate the key idea.

Sincerely,

Manuel Blay

Editor of thedowtheory.com